Ideate, Test, Iterate

Focusing on rapidly exploring and testing ways to digitally facilitate conversations - without judgement - within a family environment on the topic of money, and wealth management.

Key Goals

Guided conversations using AI driven teaching guides, and content

Insure value exchanges between family generations

Promote collaboration across family generations

Promote and guide healthy relationships

Support family members working together to achieve shared goals

Week 1 - Workshop

The team focused on generating, ideating, and narrowing concepts and supporting enablers that might promote meaningful conversations through peer-ship, self-reflection, and engagement. This initial list was used as the input for the first round of creative explorations. With the teams support I guided the client through a co-creation process. Generating high level flows, and initial screen lists.

From day two onward each morning, test results from the prior day were reviewed. The results were used in a rapid ideation session I lead with the team. Once our goals for the day were defined, I lead a blended team creating the days testing stimuli.

Throughout the week the research team conducted 17 gorilla tests with participants found on the streets of Boston. Allowing us to get feedback on 3 high level themes, and a number of feature ideas.

Learnings

Initial concept were perceived as being transactional experience, and not a relational experience

Further explorations explored concepts that better promoted peer-ship, self-reflection, meaningful conversations, and family engagement

Week 2 - Ideate & Sketch

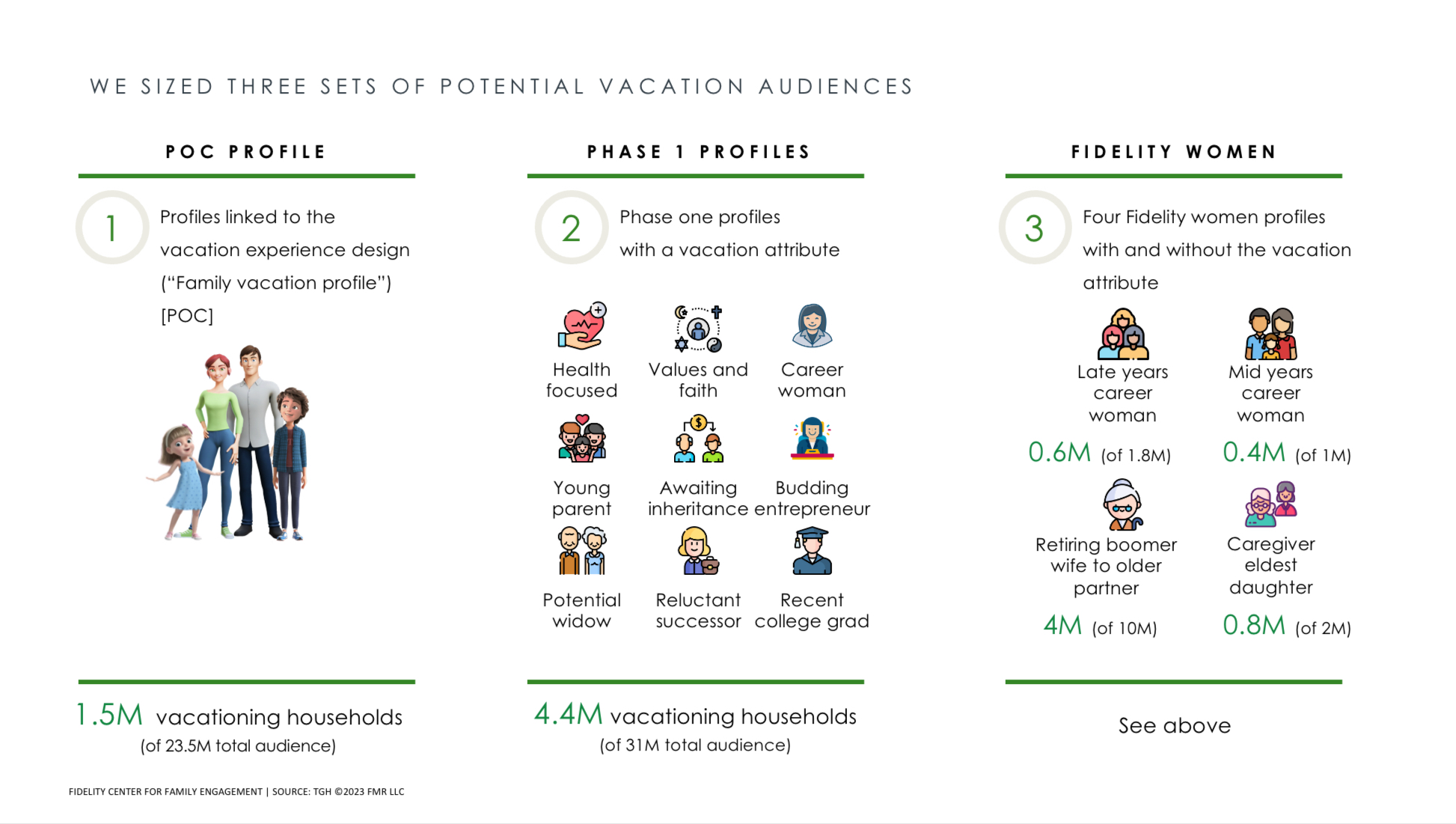

The “vacation” theme was the best received in week one tests, and was used as a foundation for this weeks experiments. Hypothesizing that famaly vacation conversations can map to multi generational money and wealth conversations. We felt this was a solid platform for us to authentically meet family member points of need through digital coaching methods across multiple generations.

The vacation theme was broken down into three concepts, the vacation therapist, vacation parenting, and vacation self-assessment. That allowed the team to explore a digital journey that explored our experience drivers, and conversation structures.

Learnings

The week concluded with a series of 12 tests against our 3 concepts. Along with feedback on our approach to supported conversation structures, we gained insights allowing us to narrow our theme focus to “vacation parenting”.

Weeks 3 through 6 - Journey Design

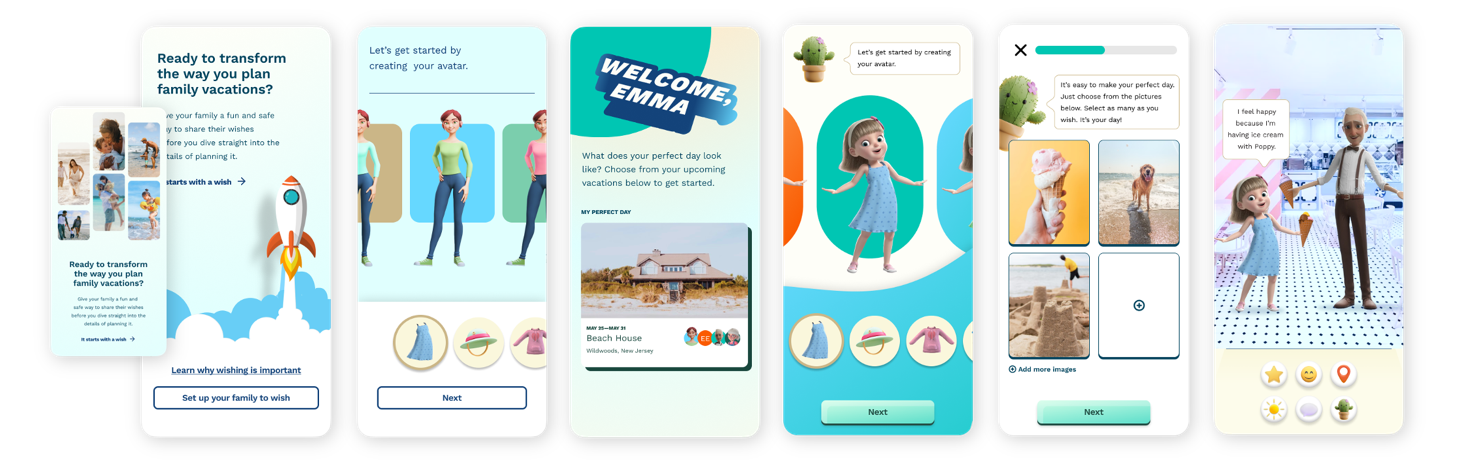

Focusing on building out the “vacation planning” theme, the team began building out a deeper narrative. Exploring how our three multi generational archetypes might come together to plan out their “perfect day”.

The team rapidly iterated through options to identify an optimal color palette and avatar set, that reflects emotions and spans across generational users. And builds on our experience principles creating a fun, personalized and extensible design system. The team also explored balancing the ease of buying avatars, with the distinction we could achieve with building our own.

Learnings and Next Steps

The next phase will test this digital experience, exploring the platforms ability to facilitate meaningful multi generational conversations. Including the platforms ability to:

Uncover family relationship, emotion and intimacy insights that can be used to strengthen the relationship with the wealth manager, and client family. In order to reduce attrition of intergenerational asset transfer via the digital platforms insights.

Reducing attrition for 2% - 4% of current accounts with an average of $1M in AUM and 1.175% advisory fee, can see a retention of $7B - $14B AUM for the firm

Target families outside of a wealth management relationship, to drive the acquisition of net new clients from the digital platform user base

The conversion of 1% - 2% of the vacation planning platforms user base into wealth management clients with an average $500K in AUM and 1.175% advisory fee, can see an additional $455M - $910M in AUM

Changing the basis of competition in the wealth management industry and create a competitive advantage. By shifting the way wealth managers work with their clients from client goal planning, to family embedded goal planing.